CADBURY owner Mondelez International has long experience of confectionery as a classic impulse category but it sees impulse opportunities in other categories too – in biscuits where it has the pioneering Belvita Biscuits range and in snacks where it had Ritz Thins.

But confectionery is the big impulse force. “The confectionery category is worth £889m in the independents and symbols channel,” said Susan Nash, trade communications manager.

“With research showing that 70 per cent of purchasing decisions are made in store, it is important to stock the right range and merchandise well.

“To maximise sales, confectionery needs to be seen. Retailers should ensure they have considered the visibility and availability of popular, core brands such as Cadbury and Cadbury Dairy Milk.

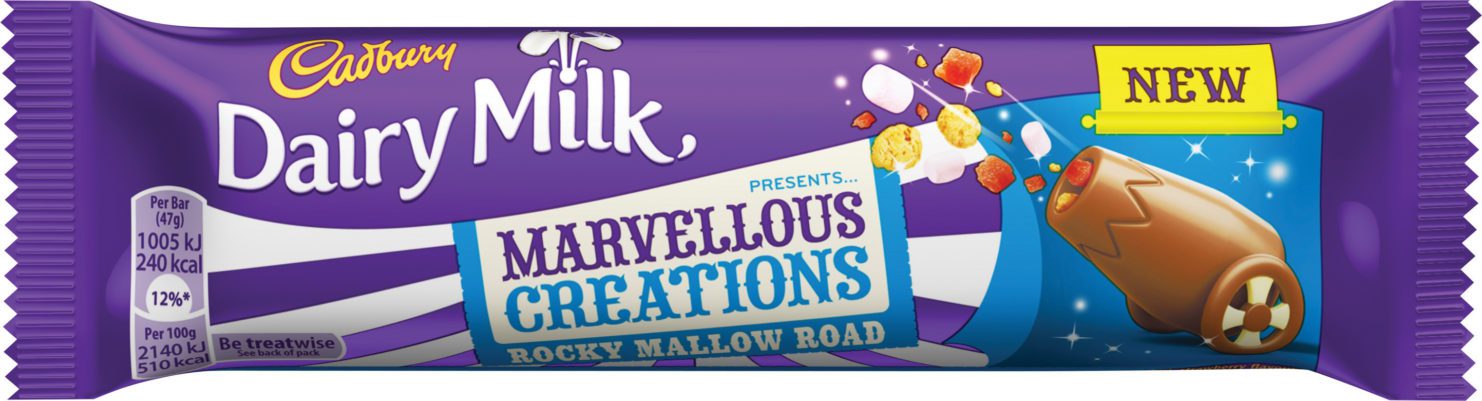

PMPs and new product development help boost interest and impulse buys. Cadbury Dairy Milk’s Marvellous range added Rocky Mallow Road last year.

“The primary confectionery display should be positioned in a high-traffic area of the store and feature all confectionery occasions including self-eat, sharing and gifting. In addition, best sellers, new lines, and lines with media investment should be located in high-traffic secondary sites.”

• Mars Chocolate UK says in-store theatre and tactical use of POS materials can drive additional confectionery sales, especially in high-footfall areas. Its recommendations include:

• Focus on merchandising the main confectionery display well, with strong availability of core lines.

• Multi-face key lines

• In pouch lines, what it sees as core favourites such as M&M’s should be displayed in a prominent location at eye level.

• Ensure you use all POS available.

• Position products such as M&Ms and Maltesers next to savoury snacks and drinks, to promote additional spending by customers planning a big night in.