Standardised packs of tobacco products, more commonly known as plain packs, are now making their way into UK convenience stores and other tobacco retailers. How should retailers respond?

THE future is now. For many months Scottish Grocer has been looking at the what, how and when around the introduction of the new tobacco retailing regulations announced as a result of two major developments.

The first concerned the European Union’s updated tobacco products directive EUTPD2 and the second the developments in the Westminster and Scottish Parliaments that meant the UK would follow Australia in implementing standardised packaging.

Many of the tobacco companies continue to challenge plain packs and wait to hear about their appeals.

But all have been required to make only plain packs for the UK market since May this year and at the same time to follow the requirements of EUTPD2 – so no cigarette packs under 20 sticks, no RYO packs of less than 30g, larger health warnings and more.

It means that 10s, 17s, 18s and other sub-20 packs, usually of value cigarettes designed to hit particular price points, will gradually become unavailable. Small RYO packs will also disappear from the market as stock made before May this year runs out. And, very importantly, the plain pack rules mean that by May next year and there will be no tobacco in PMPs in the UK.

We asked the major tobacco companies how they saw the situation at present and when they expected stock of key brands, styles and pack sizes to run out. We also asked how they were responding in terms of retailer advice and information and what they think retailers should do in terms of ranging and pricing in the new tobacco retailing world.

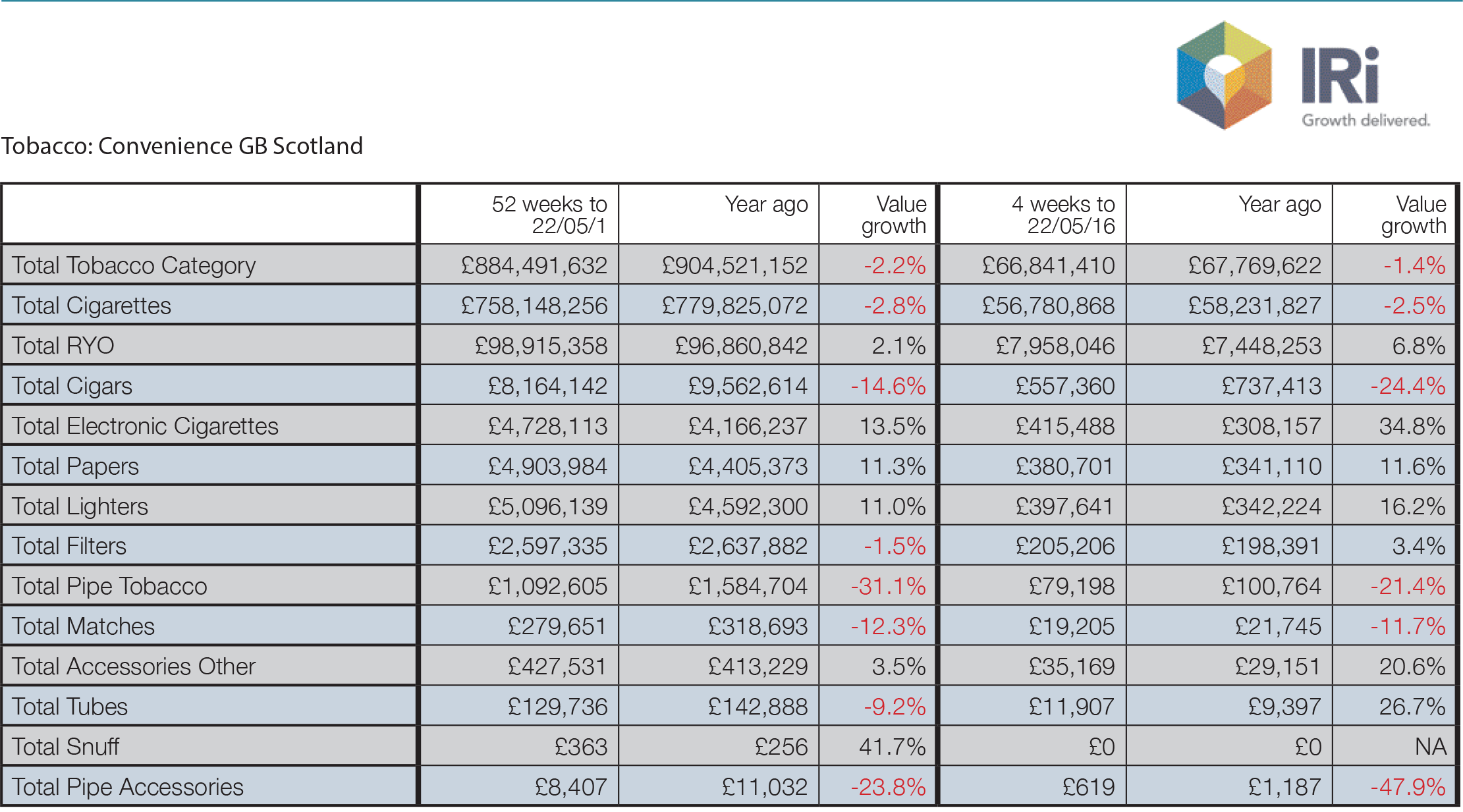

And leading retail market research company IRI has also given us valuable insight into the tobacco market in Scottish convenience outlets exactly as manufacturing of old style packs ceased and we entered the year’s transition to the new system.

Imperial Tobacco also has a retailer communication programme – Partnering for Success. which advises on the new tobacco retailing rules.

What’s the latest on stock?

At Imperial Tobacco, head of field sales Andrew Miller, reckoned the full picture on stock levels and plain pack introduction would take some time to become apparent.

“In some areas of the country, stocks of price-marked packs of certain brands are becoming scarcer, and we have already communicated that we expected them to disappear gradually from the market from June 2016 onwards,” he said.

“It is difficult to provide a detailed breakdown of stock transition periods specifically. However, we are now forecasting a transition to EUTPD2 compliant products for larger packs in the fourth quarter of 2016, and for smaller pack sizes in January 2017.”

At JTI head of communications Jeremy Blackburn didn’t want to put a date on changes.

“It is difficult to predict when new packs will appear,” he said.

“Price, popularity, stock holding, pack sizes – there are so many variables which impact on rate of sale, it is not appropriate to speculate.”

But Jens Christiansen, head of marketing and public affairs at Scandinavian Tobacco Group UK reckoned new style stock wouldn’t take a very long time to make its way on to shelves. A variety of factors had effectively meant manufacturers had concentrated on having enough stock in place to take care of logistic difficulties that resulted from the changes.

In principle, he said, manufacturers and retailers were to have a full year to rotate their old stock out of the shops.

“In reality, this time frame will be reduced due to delays and uncertainty around the final details of the regulations.

“As a result, it’s likely that many manufacturers will have stock in place to last until the manufacturing and production process can be adapted to the new EUTPD2 product guidelines.”

After 20 May 2017 tobacco retailers will only be allowed to sell cigarettes and other tobacco products in standardised packaging. But manufacturers have only been allowed to package products for the UK market in such packs from May this year.

As stocks of previously branded packaged products run out more and more legitimate tobacco products will be sold in uniform olive green packs with large health warnings and images of life-threatening illness, and with extremely limited brand and product identification.

At the same time the implementation of the amended European Union Tobacco Products Directive (EUTPD2) will mean only packs of 20 sticks of cigarettes or more and RYO packs of 30g and more will be able to be sold.

Information for retailers

The tobacco giants have been busy developing programmes to advise wholesale and retail customers on the move to EUTPD2 and plain packs and those programmes are now entering significant new phases. Importantly JTI has signalled that it will also begin highlighting aspects of the changes to consumers, in part by providing materials for use in stores.

The tobacco firms are also keen to stress the resource they provide to retailers through their field sales and business development managers.

“As the number one tobacco company, JTI endeavours to share first class insight and industry knowledge to help guide retailers through the transition,” Jeremy Blackburn said.

The firm’s Your Guide Through Change programme has three stages. The first, Business as Usual, stressed that nothing would change immediately after May 2016 and that in the early days of the 12-month transition period it was important to maintain normal methods of tobacco retailing and category management.

The programme is now entering its second stage Be Prepared, Blackburn explained.

“JTI has created an informative video and detailed leaflet to offer clear advice to ensure retailers are prepared. These resources, free to watch, read and download, are hosted on the JTI Advance website and app, meaning that retailers can access them 24/7.

“And to help retailers communicate these changes to customers, JTI is launching a consumer awareness campaign this month that includes a new website, posters and leaflets.”

At Imperial, Miller highlighted the company’s Partnering for Success programme and its materials including its START packs. Through the scheme the firm is providing retailers with the information and support to help them manage the transition to the new legislation, he said.

Disappearing PMPs

Both of the tobacco giants see pricing as vitally important for convenience retailers in a period when PMPs will come off the market, and that’s not just to maintain tobacco sales, they argue.

“With adult smokers playing a crucial role in driving both in-store footfall and basket spend in the independent channel, fostering customer loyalty before the arrival of standardised packs is crucial,” said Miller.

“Being transparent and reassuring while demonstrating your category knowledge will go a long way to retaining shopper trust as standardised packs begin to appear. To assist retailers in communicating the changes ahead, we’re distributing various point-of-sale information materials. Displaying a current price list is also a simple and effective way to communicate to customers that your pricing is competitive; take advantage of free Imperial Tobacco resources like MyTobaccoPriceList.co.uk to achieve this.”

As part of Partnering for Success initiative, Imperial Tobacco has released a video arguing that independent retailers should price at or below RRP when PMPs run out. Retailers can watch the video on its trade site www.imperial-trade.co.uk and through its retailer reward programme www.imperial-ignite.co.uk.

At JTI Blackburn said: “Before making any changes retailers should consider carefully how price sensitive their customers are.

“Many existing adult smokers are looking for value, so it’s important that retailers demonstrate to them that they are getting the best possible choice and value when making their tobacco purchases to ensure their shop remains a destination for tobacco shoppers.”

And at Scandinavian Tobacco Group Jens Christiansen took a similar view.

“As price marked packs begin to disappear, retailers need to make sure they retain the pricing they offered previously even though it’s no longer visible,” he said.

“Retailers who increase their prices as a result of it not being shown on pack are likely to scare customers away and drive them to the major multiples, feeding the trend we saw previously in the multiples around the dark market.”

Market trends

While the changes make the news it’s important to remember that retailers have to be aware of the trends in the market if they are to make the most of tobacco sales.

IRI is the only research firm to provide specific information on sales in Scottish convenience outlets and its statistical read at the end of May shows just how the market stood as the manufacturers ceased producing old-style packs.

For the 12 months to late May this year compared to the equivalent period the year before it recorded the total tobacco category in Scottish convenience outlets as worth just over £884m, down 2.2% over the year and total cigarettes were worth just over £758m, down just under 3%.

JTI highlighted the fact that value, super-value and ultra value cigarettes – including brands like its own Sovereign, Sterling and B&H Blue are gaining share in the UK and now account for more than 55% of the market.

RYO sales were up 2.1% at a smidgeon less than £99m for the year, found IRI. However RYO growth seemed to accelerate in April and May. The figures for the four weeks to 22 May this year saw RYO sales jump almost 7% on the equivalent time the previous year. Papers, filters and electronic cigarettes sales were also strongly up in that four-week period compared to the previous year.

At Imperial, Andrew Miller noted the wide variation of popularity in RYO. In South-west England it takes almost 46%% of volume tobacco sales. But in Scotland factory-made cigarettes maintain a 75% share.

Cigars seemed to take a hammering in Scottish convenience. The figures for 12 months were down almost 15% to £8.2m and the results for the four-week period to 22 May dropped by almost 25%.

But at cigar specialist Scandinavian Tobacco Group Jens Christiansen argued that cigars might prove advantageous to tobacco retailers.

“As a result of the minimum pack sizes being brought in as part of EUTPD2, the cigar category may stand out and attract existing cigarette smokers due to the fact that when the changes are put into effect, some cigars will by far be the cheapest option on the shelf for price,” he said.

“STG UK has a number of leading brands within its portfolio, most notably Café Crème which is the number-one cigar brand in the UK.

“Café Crème Blue alone accounts for 22.6% of cigar sales making it a must stock for any tobacco retailer.”

JTI’s Jeremy Blackburn said its cigar brand Hamlet holds a 36% share of the cigar category in the independent trade, is one of the top three cigar houses in the UK.

And retailers report it to be the most recognisable cigar brand, he said.

Imperial Tobacco said its brands account for almost 34% of all small cigar sales in the UK. Classic currently accounts for just under 25% of the small cigar sector, and 6.5% of the cigar market as a whole, it added.