Cigars, like most tobacco products, continue to face difficult and restrictive market conditions. But fears that the dark market may have had a particularly harsh effect on sales of products whose performance was apparently influenced by impulse purchases haven’t been realised, according to Britain’s main cigar suppliers.

And, actually, with more restrictions on the horizon for cigarettes and RYO products (if legal challenges fail and the provisions of European Tobacco Products Directive 2 are implemented) cigars, which will not be forced to have higher minimum pack sizes and, therefore, to have higher entry price points, could actually benefit from legal changes for once.

Underlying market trends see sales under pressure overall. But certain segments are doing well, miniatures have now become established as by far the most important cigars sub-category in terms of volume sales. And value-for-money miniatures are showing growth – a flight to VFM that mirrors trends in cigarettes and RYO tobacco.

At Scandinavian Tobacco Group UK, brand owner of the market-leading Café Crème range of miniature cigars, head of sales Alastair Williams said that it’s still too early to say what effect the extension of the tobacco display ban to small stores is having but he suggested that it will mean that availability is even more important than before to cigar sales.

It’s possible that some consumers may default to well-known brands, value for money or niche products, he said.

Now the display ban is in place some retailers will undertake range reviews remove products that aren’t well-known brands or top sellers, he acknowledged. However, the emphasis is on retailers to identify the right range for their store, based on the products rate of sale and customer base, and adjust their range accordingly, he said.

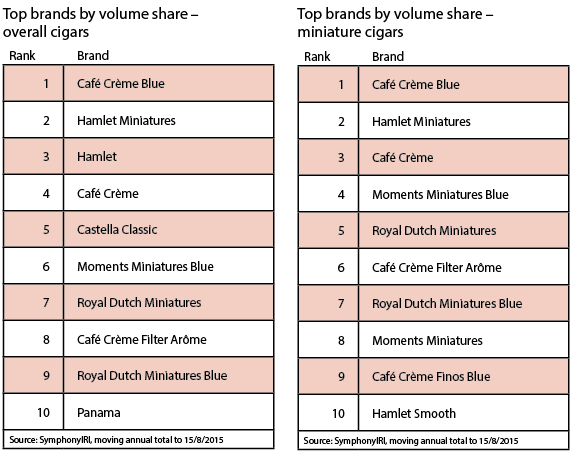

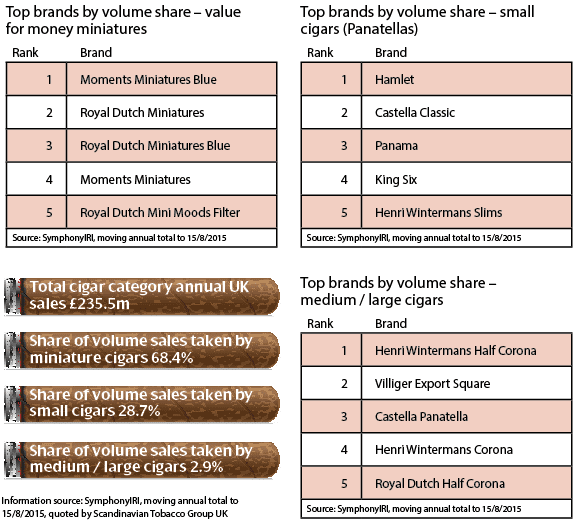

Quoting SymphonyIRI market research data to August this year STG UK said total annual cigar category sales were £235.5m and that miniature cigars now accounted for more than 68% of volume sales in Britain.

Value cigars continue to do well, said Williams. The firm says its value line Moments miniatures, typically sold at £3.83 for a tin of 10, is now the fastest-growing cigar brand in the UK.

And PMPs remained important in a dark market he argued as they still offer consumers reassurance on price and value, he said.

Larger cigars do also have enthusiasts and the celebratory moments of the festive season are approaching. Williams explained that the firm’s Henri Wintermans Half Corona and Slims are available in outers of 5 x 5 and its new hygro-foil packaging means the cigars have been individually bar coded, which allows them to be sold as singles.

At tobacco firm JTI head of communications Jeremy Blackburn, quoting the company’s own estimates said the overall UK cigar market is worth around £230m

Approximately one third of cigar sales are sold through the independent trade, he said.

Sales in independents are, by the company’s estimates, significantly dominated by miniatures, which it reckons take a 59% volume share. But it also sees standard-sized cigars as important, retaining a 36% share.

It says its Hamlet portfolio holds a 38% share of cigar sales in independents.

Given the introduction of the retail display ban the firm says it’s more important than ever for retailers and their sales staff to understand the most popular cigar packs formats and what sells well in their region. The JTI salesforce continues to recommend its ARTIST merchandising strategy to retailers – a six-step guide developed by the company which stresses: Availability, Range, Training, Innovation, Sales and Technology.

And the firm also provides information on the tobacco category for retailers at its trade website www.jtiadvance.co.uk

Earlier this year JTI introducing new pack designs and formats across the Hamlet range.

The Hamlet singles 50s drum was made available as a half outer for the first time and Hamlet miniature 10s are now packed in a more compact tin.

“The range also offers impressive PORs for retailers of up to 21.3%,” said Blackburn at the time of the launch.

l Profitability of cigars is a characteristic of the tobacco market that isn’t always clearly understood, reckons Andy Swain, field development manager for cigar specialist Ritmeester, brand owner of Royal Dutch Miniatures and Mini Moods.

And it’s a subject that he’s keen for the company’s expanding sales force in the convenience channel to address with symbol and independent retailers. He sees it as all the more important now that the market has gone dark. While he acknowledges that the cigar category and other tobacco products probably saw some pain when flaps went on to gantries in January and February, ahead of the April deadline he reckons damage was short-lived and overcome by shoppers becoming used to the new regime.

“Business is exactly where we wanted it to be. We’re on course again this year, despite it being a dark market, to double our volumes in convenience.

“We increased our salesforce and we’re working to educate retailers about the cigar category, it’s very undervalued. The rate of sale isn’t as great as cigarettes or RYO, but profitability is significantly higher.

“The big thing that’s continuing to drive our sales is the on-shelf price of our price-marked packs of 10 Royal Dutch Miniatures at £3.95. We’re in a growth stage so we absorbed a duty increase, we haven’t changed price since the middle of last year.

“That backs up the consumer shift to value products, provided they match the quality of the brand leaders.”

Swain is particularly bullish about the opportunities for cigars and cigarillos, which won’t be affected by new statutory minimum sizes, if the European Tobacco Products Directive 2 (which are still being legally challenged by a number of tobacco companies) are implemented.

He reckons the cheapest price that buyers of legitimate tobacco products will be able to pay in the UK for any pack of cigarettes will likely be £7 or more and all the small packs of legitimate RYO stock will disappear. Miniature cigars and cigarillos will still be available in 10s and other sizes, with some prices below £4 and many below £5.

The UK hadn’t taken to cigarillos in the same way as much of Europe and North America, he said. But he thought there could be a move towards cigarillos after ETPD 2 and the company is working to get the right products to the market.

Andrew Miller, head of field sales at Imperial Tobacco UK said the firm sees the UK cigar market as separated into three segments – miniature, small and large – with brands from the miniature segment having continued to increase market share in recent years, to the point where they now account for almost 69% of all retail cigar sales by ITUK figures.

“We estimate small cigars account for approximately 28% and large cigars 3% of market,” he said

“While cigar sales are impacted by the seasons it is important for retailers to ensure constant availability of leading brands. Range is also key – 38% of cigar consumers will choose different cigars for different occasions, meaning it’s imperative that retailers offer a wide range of brands.”

Imperial estimates that its Classic brand currently accounts for just under 25% of small cigar sector sales and a little under 10% of the total cigar market as a whole.

Classic is available in 5s packs at £5.58 RRP or as single cigars (in 50s drums) at an RRP of £1.16 each.

He said Panama 6s packs (RRP £5.46) and King Edward Coronets 5s packs (RRP £5.25) sell well and, overall, Imperial Tobacco brands account for almost 35% of all small cigar sales in the UK.

Seasonality plays a big part in cigar sales with two periods of importance being the festive ‘party season’ months and summer when improved weather often influences sales increases, he added.