F ROZEN foods have done well since the recession arrived. A number of frozen food sub-categories, especially burgers, were negatively affected by the horse meat scandal but even those have bounced back.

ROZEN foods have done well since the recession arrived. A number of frozen food sub-categories, especially burgers, were negatively affected by the horse meat scandal but even those have bounced back.

And it looks as if last year frozen products had a relatively good time once again, especially in Scotland.

Mark Thomson, business unit director of retail research specialist Kantar Worldpanel told Scottish Grocer that the take-home GB frozen food category was worth £5.7bn over the year to 4 January 2015, and had grown by 0.8%. However in Scotland, where the category is now worth £513m, growth was ahead of GB performance – sales north of the border were up by 2%.

On the other hand that means the average Scottish shopper is just catching up a little with spending trends across Britain. On average Scottish shoppers spent £200 on frozen food over the year, which is still £18 less than the GB figure. Shoppers across GB and Scotland each made an average 47 shopping trips that included the purchase of frozen foods over the year.

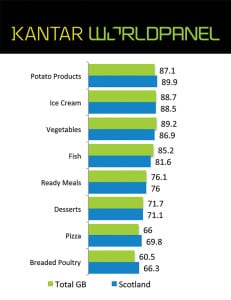

There are frozen food sub-categories that are especially strong in Scotland.

Potato products account for 14% of all frozen food spending in Scotland compared to 11.8% in total GB.

Sales of ice cream represent 16.2% of frozen food spending in Scotland as compared to 14.9% across all of GB, despite the weather being colder. Other strong frozen food sub-categories in Scotland include frozen desserts, pizza, and sausages.

However, in the 12 weeks up to Christmas, frozen food had a tough time with sales down 1.4% in Scotland which was partly due to shoppers trading up to fresh and chilled equivalent food.