Ready-to-eat cereal is a staple in many households. But there’s a new kid on the block and it’s growing in the convenience market, offering hot on-the-go products designed to appeal to increasingly busy consumers.

IF the stories are to be believed, in today’s busy world most consumers would rather miss breakfast than risk being late for work.

Luckily local convenience stores can be the saving grace, offering a range of on-the-go breakfast products so that frantic consumers can get to work on time and still eat sensibly.

Where once breakfast might have been ignored by busy workers keen to make the most of their mornings, now more and more people are choosing to eat it on the go or at their desks.

However if on-the-go, early-morning eats are on the up it’s still the case that most breakfasts are eaten at home. And, when it comes to traditional forms of domestic consumption, breakfast plays a bigger part in at-home eating in Scotland than in Great Britain overall.

Kantar Worldpanel data for the year to November 2013 shows that 26.7% of food consumed in the home in Scotland was for breakfast compared to the GB average of 26.4%.

So, for retailers of all sizes, including local stores and other c-stores, it’s important to be able to meet demands for Scottish shoppers looking to stock up on breakfast products in preparation for the morning rush or, indeed, for more relaxed weekend breakfasts.

For Scottish consumers, enjoyment appears to be key. Kantar says 65% of them say they eat breakfast to ‘enjoy the taste’. But other reasons such as speed of preparation and health are also motivating factors when it comes to deciding how and where to eat breakfast.

In terms of what to eat, cereal is still top of the pops. Kantar figures show that cereal features in 50% of all breakfasts. White bread or toast appears in 21%. The company also says Scots consumers are more likely than the GB average to choose porridge oats or toast to fill them up in the morning.

But the move toward breakfast on the go is increasing steadily among younger consumers. Kantar says those with no kids are less likely to eat breakfast at home.

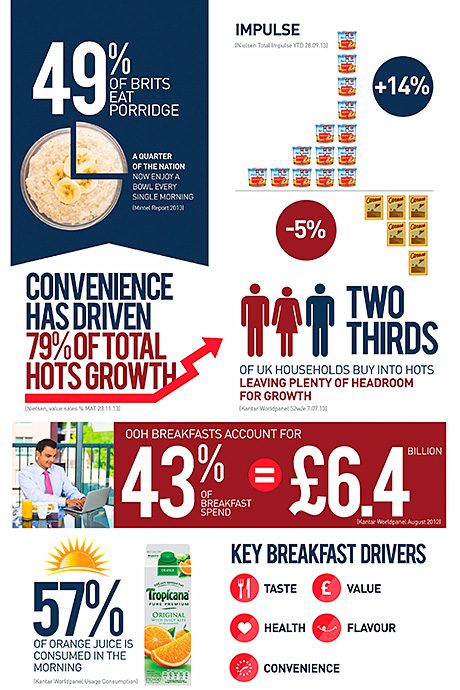

Other statistics note interesting trends and developments in the breakfast cereals market. One of the most important has been the increasing importance of hot cereals

The Key Note 2013 market report on breakfast cereals says that between 2008 and 2012, the hot cereals sub-category grew by 51.7% to £179m. Porridge increased in value by 18% in 2012 alone and hot cereals made up 11.7% of the total market in 2012 compared to just 8.8% in 2008.

Products like porridge are also more widely available than before in on-the-go and instant formats as brands try to appeal to busy breakfasters.

Quaker Oats is the leading supplier in the hot cereals category according to Key Note. It unveiled a range of Quaker Heaps of Fruit porridge pots and sachets in 2013 aimed at younger consumers. For 2014 it has released a Quaker Oat So Simple Multi-Grain range, again aimed at the health-conscious, busy young consumer looking for a quick and filling fix.

Quaker brand owner Pepsico says breakfast is a key opportunity for retailers to cash in on sales of hot cereal. Nielsen research, it says, shows that the sub- category has doubled in value since 2005 and is increasing the overall consumption of breakfast products.

Pepsico says Scottish retailers can tap into the trend for porridge eating by having the right range and right display of appropriately priced and positioned products.

The firm says Kantar research shows that on-the-go breakfasts make up 19% of all breakfast occasions and account for 43% of spending on breakfast lines. It says shoppers are willing to pay more for convenient products like its Quaker Oat So Simple pots and sachets.

On ranging and pricing the firm argues that small retail outlets can make the best of breakfast product sales by stocking a core range of those breakfast products that deliver the biggest profits. Large stores can afford to stock a wider range of formats, flavours and new products, it reckons.

Health cereals

Health cereals provide another category that could prove lucrative for retailers.

Key Note suggests that many hot cereals such as porridge are perceived as healthier than ready-to-eat cereals, such as corn flakes, because they’re seen as having fewer added sugars and preservatives.

And after hot cereals, the research found the fastest growing sub-category was health cereals. Products with the most rapid growth in 2012 were health cereals and muesli, it said, both of which increased sales by 3.9% – to £331.5m and £190.8m respectively. Indulgent breakfast cereal products such as cereals combined with fruit and nuts, saw sales grow by 2.5% to £169.1m according to the report.

Pepsico says there is a big opportunity for retailers to increase sales of cereals by stocking premium and healthy options. But, as has been noted, Kantar Worldpanel found that Scottish consumers don’t want to compromise on taste and want to enjoy their morning meal.

Mornflakes’ re-sealable granola and muesli ranges are marketed as affordable luxuries for consumers short of cash who still want to treat themselves.

The company is promoting its range as providing indulgent but healthy breakfasts. The 500g pouches have an RRP of £2.65 and are available from wholesalers and cash and carries.

The two flavours, Plum and Almond Oatbran Granola and Cranberry and Nut Oatbran Muesli are both sanctioned by the Heart UK charity.

Children’s cereals

Children’s cereal products were another of the fastest growing sub-categories in the breakfast cereals market, said Key Note.

And while grown-ups may be increasingly choosing to breakfast at their desk households with kids are much more likely to include shoppers who are looking for take-home breakfast items.

Kantar Worldpanel found that families with children aged 0-4 years are most likely to eat breakfast at home, followed by families with children aged 5-9 and families with kids aged 10+.

And, among those consumers, ready-to-eat cereal is the product of choice, largely due to its convenience. Key Note says that between 2011 and 2012, children’s ready-to-eat cereals sales rose by 3.5% to £350.4m.

Ready-to-eat cereals might be quick and easy, and that can be the major attraction in many households, but some parents (perhaps a growing proportion) also want to make sure that their kids are eating well in the morning, according to consulting group Engage Research. The firm says brands (and it might follow, retailers) should take care when marketing children’s cereals to highlight a product’s health benefits.

Hetta Bramley, Engage Research director, said: “If you look at children’s breakfast cereal brands, ask yourself what a product in this category needs to say about itself in order to maximise its chances of success.

“Cereal manufacturers know that mums worry about nutrition, and that kids want taste, you don’t need research to tell you that. But it is much more complicated.

“Often mums just want something kids will eat, first and foremost. And some just pay lip service to nutrition as long as they get something the children will eat quickly and without complaining so they can get them off to school.

“Some mothers do place nutrition higher up their scale of priorities but understand so little about it that just having ‘no added sugar’ or similar on a pack may be enough to convince them.

“It is thought, however, that concerns over the nutritional content of children’s cereals will continue to impact on demand. With some health campaigners claiming they are high in sugar and salt and low in nutrients, brands must be able to demonstrate that their product does not fit this profile.

“In addition, there is growth in other areas of the breakfast category – cereal bars, breakfast biscuits and instant porridge – that give consumers options to move away from conventional boxed cereals.”

Pepsico’s top tips for making the most of breakfast sales

• Focus on a core range of best-selling breakfast products.

• Increase visibility of hot breakfast products over the winter sales period to increase seasonal sales.

• Stores with coffee machines should promote lines like its Oats So Simple pots as breakfast-to-go that can be made by adding hot water in store.

• Offer breakfast meal deals featuring single-serve sized juices like Tropicana Single Serve and porridge pots.

• Use clip strips to site breakfast pots alongside juices or next to hot drinks.

• Where hot breakfast items are performing well add new flavours and formats.